Big news: Aaddress.in is now Address.co ✨

Why GST Applications Get Rejected (and how to fix it the right way)

Most rejections happen for simple reasons. If you fix those, approval becomes routine. Use this page like a checklist and file with confidence.

Part 1: The real reasons applications get rejected

1) Address proof that does not meet GST expectations

What usually goes wrong

- Using a residential proof when the officer expects a commercial address.

- Utility bill without the owner’s name or with an outdated billing period.

- Informal rentals where there is no proper agreement or owner authorisation.

How to fix it

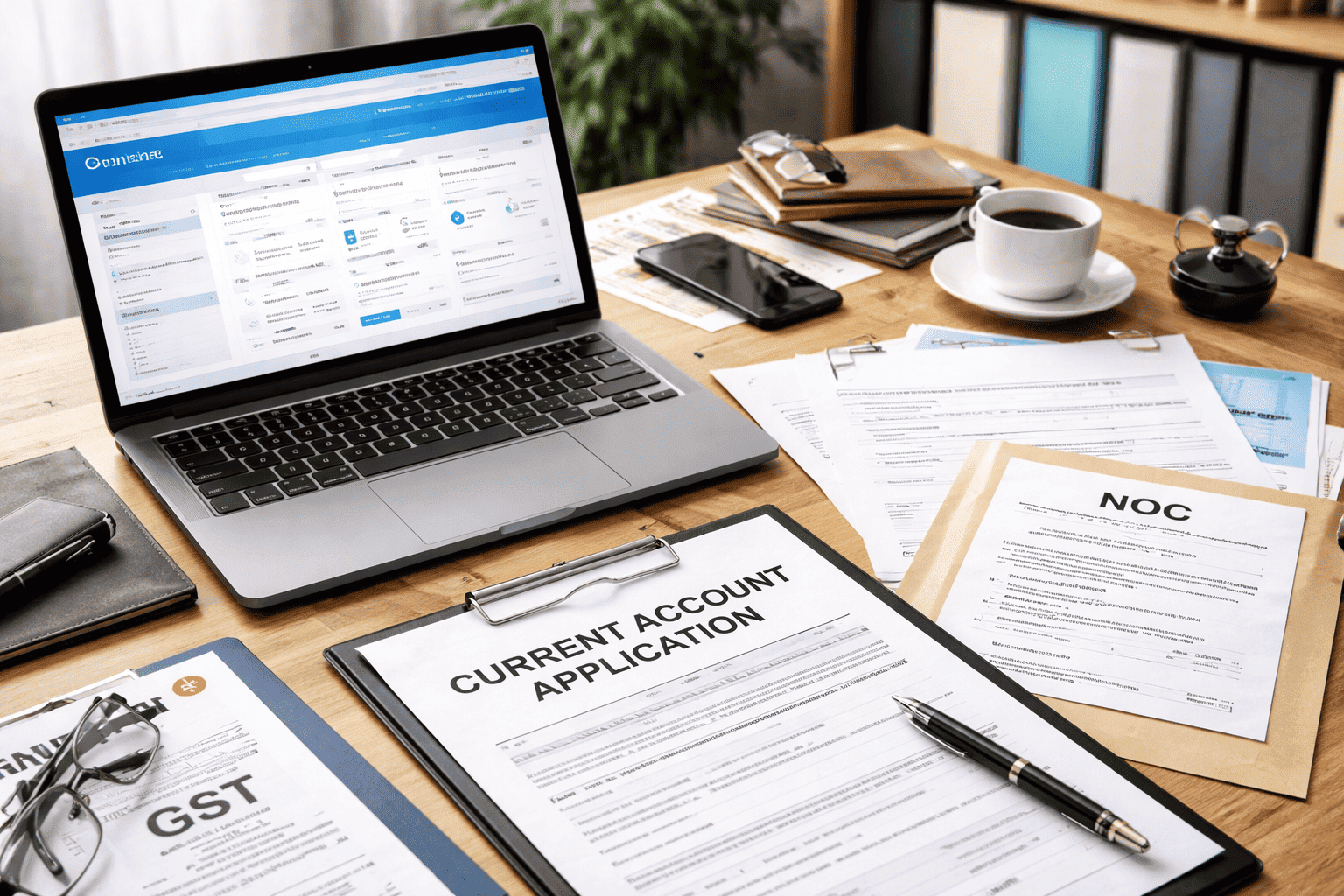

- Use a commercial address with three clean documents: recent utility bill, rent or lease agreement, and the owner’s NOC.

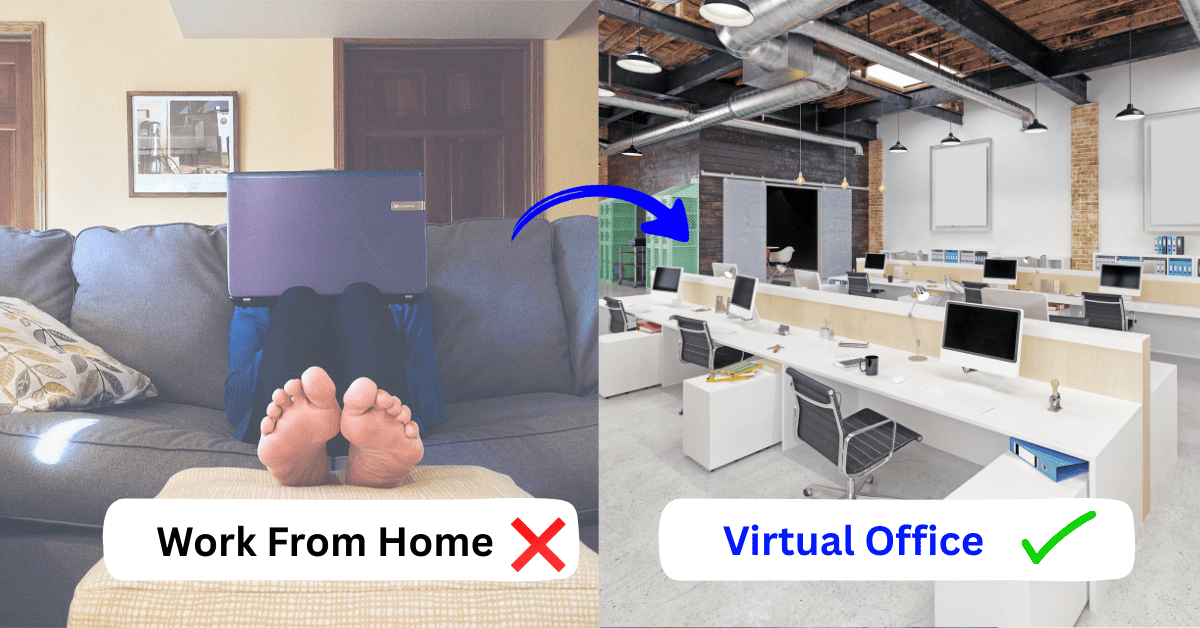

- If you work from home, consider a virtual office that provides a compliant document pack and reception presence for verification.

2) Inconsistent details across your papers

What usually goes wrong

- One letter difference in the address between PAN, Aadhaar, bank statement and the GST form.

- Missing flat or plot number. Wrong PIN code. Locality spelled two different ways.

- Business trade name appears differently across bank proof and application.

How to fix it

- Write one master version of your address:

Line 1: Flat or Plot, Building

Line 2: Street, Landmark

City, State, PIN

Copy this text exactly into every document and form. - If a bank proof shows an older address, ask your bank for a fresh statement or letter with the updated address.

3) Field verification fails

What usually goes wrong

- Officer visits and finds no signage or no one available.

- The site looks like a home and not a place of business.

- The reception is unaware of the firm name mentioned in the application.

How to fix it

- Keep a simple name board ready. Even an A4 acrylic plate near the entrance helps.

- Ensure someone can acknowledge the visit.

- With a virtual office, align the visit window with the reception team and share the displayed firm name exactly as in your application.

4) Document quality issues

What usually goes wrong

- Blurry scans, cropped pages, shadows on the edges.

- PDF size too large for the portal.

- Missing signatures or missing landlord PAN when asked.

How to fix it

- Scan in good light, crop edges, and save to PDF.

- File names that help officers:

01_UtilityBill.pdf, 02_RentAgreement.pdf, 03_OwnerNOC.pdf, 04_PAN.pdf, 05_Aadhaar.pdf, 06_BankProof.pdf. - Use recent proofs. If a utility bill is older than two or three months, request a fresh one.

5) Business activity not described clearly

What usually goes wrong

- Vague description like “services”.

- Wrong HSN or SAC.

- For e-commerce sellers, no mention of marketplaces or additional places of business.

How to fix it

- Write a simple and exact description. Example: “Online sale of apparel through Amazon and Flipkart” or “IT consulting and custom software development”.

- Pick correct HSN or SAC. For mixed activities, list the primary one clearly.

- If you store or ship from other states, add those as additional places of business with proper documents.

Part 2: Five short caselets that mirror real life

- Ritika, Jaipur – Sells home decor on Meesho. Rejected due to a residential address. She switched to a virtual office address, uploaded the new document pack and got approval.

- Arun, Noida – SaaS founder. Address mismatch between PAN and bank statement. Updated bank proof to match the master address and passed verification.

- Jaspreet, Ludhiana – Officer visit failed. No signage at the site. Kept a small name board ready and informed reception. Approval came through.

- Neha, Pune – Uploaded a rent agreement with unclear pages. Rescanned, combined pages neatly into one PDF, added page numbers. Application accepted.

- Faisal, Bengaluru – Chose the wrong SAC. Corrected the activity description and code, then replied to the notice. Approved.

Part 3: Self-audit before you hit Submit

Identity and bank

- PAN and Aadhaar are readable.

- Bank proof shows the correct business or proprietor name and IFSC.

Address

- One master address used everywhere.

- Commercial address proofs ready: utility bill, agreement, owner NOC.

- Contact person available for field visit.

Documents

- PDFs are clear and under the portal size limit.

- Every page is visible. Signatures are present where needed.

Business activity

- Description is specific.

- Correct HSN or SAC chosen.

- E-commerce details and additional places of business are listed when relevant.

Part 4: Virtual office explained in two minutes

A virtual office gives you a legally acceptable commercial address for GST and other official work without paying for a full office.

What you typically receive

- Recent utility bill for the property.

- Rent or service agreement in your firm name.

- Owner or lessor NOC.

- Reception support for courier and government letters.

- Assistance during field verification and signage where applicable.

When it helps the most

- You work from home but need a commercial address for GST.

- You sell across states and want additional places of business without long leases.

- You want a professional presence while keeping fixed costs low.

Part 5: A simple filing plan you can reuse

- Pick your city and locality based on delivery reach and client perception.

- Collect the address document pack from your provider.

- Create your master address block and paste it into all forms and proofs.

- Prepare bank evidence that shows the right name and branch details.

- Fill the application carefully and upload clean, well-named PDFs.

- Coordinate the verification window. Keep signage and an authorised contact ready.

- Track your application daily. If you receive a query, answer with the exact document requested.

Part 6: If you already got a rejection

- Read the reason line by line.

- Fix the cause, not just the symptom. Example: do not reupload the same residential proof if the officer asked for a commercial document.

- Prepare a short cover note inside your reply that says what changed.

- Reapply with the corrected set.

Short cover note sample

“Officer had flagged residential proof. We are submitting a commercial address pack that includes the latest utility bill, rent agreement and owner NOC. The address now matches PAN and bank proof. Signage and contact person are ready for verification.”

Part 7: Practical tips that save time

- Keep a single folder on your drive with the final PDFs. It becomes your template for future state filings.

- For names, follow the spelling on PAN. If your trade name is different, keep it consistent across bank proof and the GST form.

- For addresses, match the local spelling used by the postal department and confirm the PIN.

- If you sell on marketplaces, add those details once so you are not asked for them later.

Final word

Most GST rejections are preventable. If you use a clean commercial address pack, keep your address text identical everywhere, upload clear PDFs and prepare for a simple site visit, approval is usually straightforward. A virtual office gives you these pieces in a tidy bundle and keeps your monthly costs light.

Need a compliant address in your city with documents ready for GST?

Reply with your city and we will share location options and the exact document list you will receive.

Subscribe To Our Newsletter

Conquer your day with daily search marketing news.

Most popular Blogs

Google Business Profile & Virtual Office Address: What’s Allowed in 2026 (SAB vs Hybrid)

The address you use on your Google Business Profile (GBP) can either help you rank...

Read Full ArticleReading Time: 5 mins.Change Registered Office to a Virtual Office: INC-22 + MGT-14 Checklist (With Samples)

Overview The main thing that matters when you move your company's registered office to...

Read Full ArticleReading Time: 5 minutes.Current Account with Virtual Office Address: Documents + Bank-wise FAQs (India)

In India, you can open a current account with a virtual office address as...

Read Full ArticleReading Time: 3 min.How to Change GST Address Online (Switch From Home to Virtual Office): Step-by-Step (2026)

Quick Summary: If your GST address is in the same state, you can...

Read Full ArticleReading Time: 4 Mins.